As the year comes to a close, it is clear that there were two major performance drivers. The first was the macro. 2023 will go down as the year that the US Federal Reserve successfully raised rates from zero to 5% without crashing the economy, spurring share markets to new highs. The second driver was the roll-out of artificial intelligence. Well capitalised disruptive companies benefited most from this, extending their leadership over the market.

Source: Bloomberg

Source: Bloomberg

Nowhere has this phenomenon been more widely observed than with the Magnificent Seven.

The bottleneck for AI products was (and continues to be) the hardware. Compute is needed to produce each new AI model and even more compute is needed to run that model iteratively.

Nvidia‘s hold over hardware in the form of graphics processing units (GPUs) and its DGX platform is the key input for AI. Amazon, Alphabet, and Microsoft are the cloud hosts of AI training and inference while Alphabet and Microsoft are the two leading rivals, competing to bring AI products to market. Not to mention that Meta and Tesla integrate AI into their respective advertising and autonomous driving businesses.

Whatever other beneficiaries of the large language model (LLM) product developments (and there will be thousands) the foundation models are the critical building blocks. Alphabet and Meta produce Gemini and Llama respectively while Microsoft makes uses of OpenAI’s GPT models.

As GPUs become increasingly important in datacentres, there will need to be upgrades across central processing units (CPUs), networking and memory. These components are the domain of Advanced Micro Devices, Arista Networks, Micron and others. Additionally all three of the cloud titans – Amazon, Alphabet, and Microsoft, now design custom semiconductor chips for their own use. Much of the physical manufacture or fabrication of these leading edge semiconductors is handled by Taiwan Semiconductor Manufacturing Company.

Amazon’s AWS, Microsoft’s Azure and Alphabet’s Google Cloud were growing at +20%, +45% and +37% respectively year-over-year at the end of 2022 – before the advent of LLM workloads (albeit this was before a period of cyclical cloud spend optimisation). AI workloads have only begun to be deployed at scale, such as Microsoft’s Copilot which went live in November. We believe there is a long ramp still to come.

The Loftus Peak portfolio also has significant exposure to the recovery in digital advertising through Meta and Google. 2022 was a year of weak advertising spend making for easy comparables in 2023. The cyclical re-acceleration is further accentuated by the secular move from traditional advertising to digital advertising.

We have also seen this in the emergence of advertising tiers across streaming services like Netflix and Amazon Prime while importantly, Roku reported positive GAAP EBITDA for the first time since 2021.

Tesla (not held in the portfolios we manage) delivered strong share price performance during the year on the increased digitisation and electrification of automobiles. We acknowledge this but believe there is better value in holding the companies that enable this digitisation and electrification such as ON Semiconductor, Infineon and Wolfspeed in the case of electrification.

Indie Semiconductor is yet another pure play exposure to automotive digitisation, while another key holding, Qualcomm is becoming increasingly involved as the communication chips which were once primarily used for smartphones are finding use cases in a range of end markets, including automobiles. Not to mention that Nvidia’s chips underpin the machine learning required for autonomous driving.

Where do we go from here?

The Magnificent Seven have had a tremendous year. But it is important to see this performance in the context of the last market high (a little over two years ago).

Source: Bloomberg

Source: Bloomberg

Throughout 2022, these companies were priced for structural headwinds that never materialised. Only Apple, Microsoft and Nvidia have meaningfully outperformed our benchmark since the market highs of 2021. Moreover, the business opportunities of Microsoft and Nvidia have evolved rateably over the last twelve months.

For the Meta, Alphabet and Amazon, the erasure of the structural headwinds has only brought these companies back to levels in keeping with their core business from a couple of years prior. We believe the market is yet to price in the AI and other opportunities these companies have in their respective businesses.

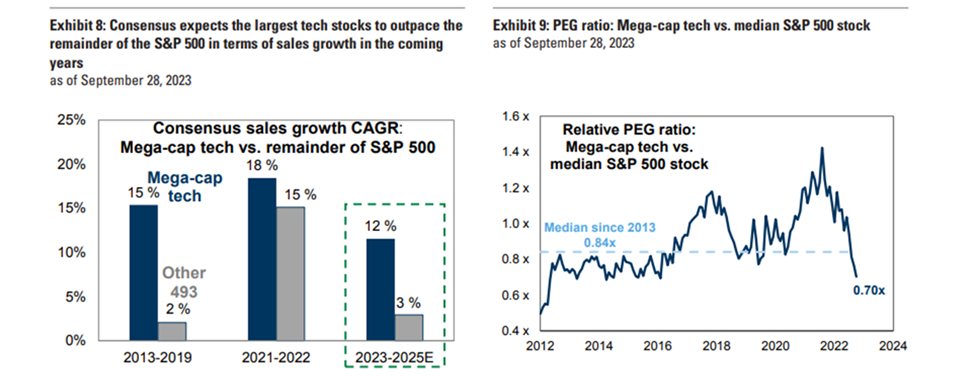

This view is corroborated in the sales outlook for the Magnificent Seven.

Source: Goldman Sachs, Mega-cap tech refers to the Magnificent Seven

Source: Goldman Sachs, Mega-cap tech refers to the Magnificent Seven

Between 2023 and 2025, the Magnificent Seven are expected to grow sales at four times the pace of the S&P 500. Translating this into a relative price/earnings to growth (PEG) ratio, these companies trade at their lowest point in nearly a decade.

As 2024 approaches, the promised rate cuts have extended the rally in equities. We will take care to trim positions which have become overbought, adhering closely to our valuation process and constantly adjusting for risk.

In periods of acute stock market elation, companies can markedly outpace their valuations. Those same companies would be prime candidates for a sell-off if market sentiment turned. We do not aim to invest based on changes in market sentiment, rather to changes in the fundamental value as we see it. This will continue to be our strategy going forward.

Share this Post