Welcome to Update+, a short tour around the grounds of investment in the big disruptive trends that are driving business. This month, Chief Investment Officer Alex Pollak provides a summary of … Read More

What will disrupt the disruptors?

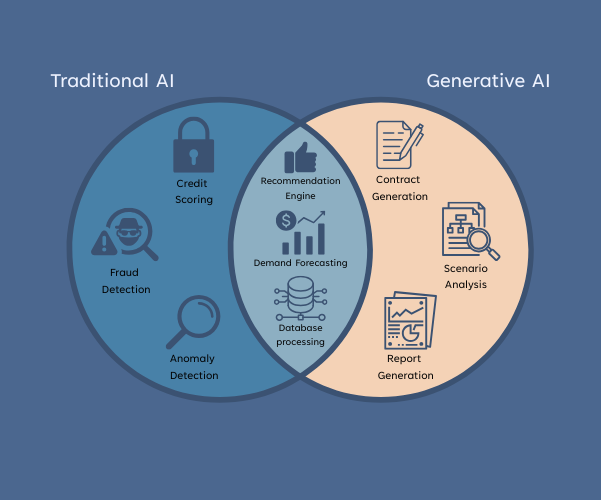

Source: ChatGPT Google’s Gemini disrupting Google? A question that Loftus Peak has often been asked over the years is: can the disruptors be disrupted? There is a ready answer. The largest, … Read More

E&P’s Words on Wealth Podcast interviews Alex Pollak and Raymond Tong on ‘AI’s Expanding Reach’

Loftus Peak is pleased to have been invited to speak with the team at Evans and Partners on their Words on Wealth Podcast. The theme of this episode is ‘Words on … Read More

‘Beating the market in a time of hyper-disruption’: Alex Pollak features on EquityMates Basis Points

Loftus Peak is pleased to have been invited to speak with the team at the EquityMates’ Basis Points Podcast. The theme of this episode is investing in ‘Beating the market in … Read More

Cage fight: Trump v Musk! Alex Pollak features in SBS On the Money

Were it not the US President and the world’s richest man scratching at each other, it could have been mildy amusing. But the respective positions of both men mean outcomes could … Read More

ASX’s The Idea Exchange Podcast interviews CIO Alex Pollak on ‘The art of disruption’

Loftus Peak is pleased to have been invited to speak with the team at the ASX’s The Idea Exchange Podcast. The theme of this episode is investing in ‘The art of … Read More

AI stocks surge as bond and equity markets diverge

Another month, another Trump tariff Another month, another Trump tariff, this time on the EU – and already paused until early July – and now struck down by the US Court … Read More

May 2025 Update+

Welcome to Update+, a short tour around the grounds of investment in the big disruptive trends that are driving business. This month, Investment Analyst Tom Gilbertson is checking in from the … Read More

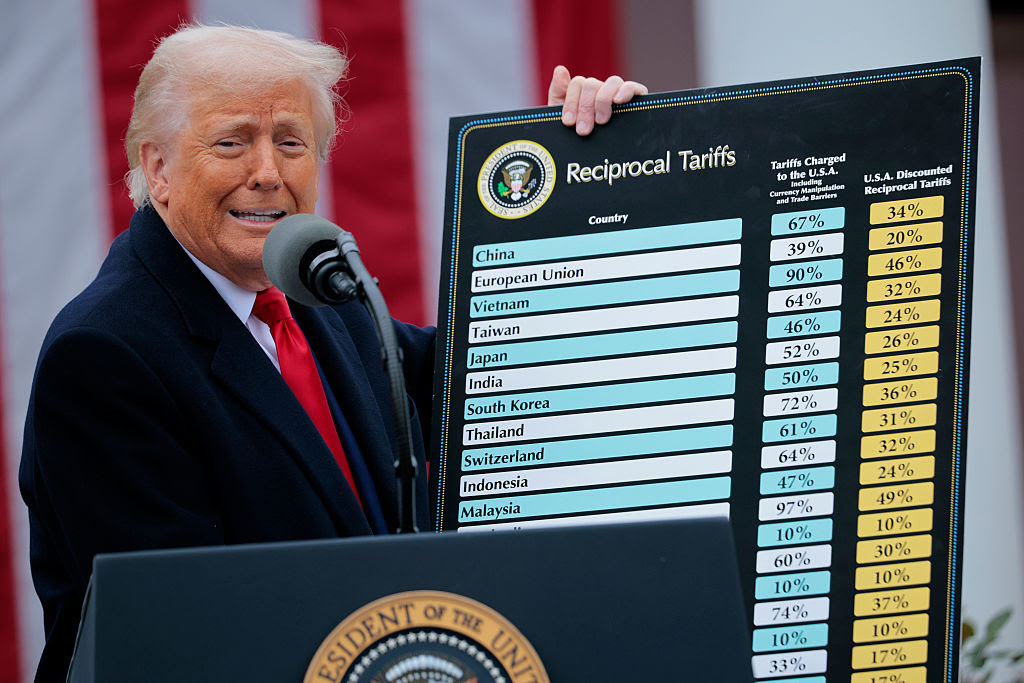

Faced with the bond market, Trump blinks

Few believed that 100 days into the Trump presidency, the US would emerge as the epicentre of upheaval for global trade. The impact financially is that US indices have underperformed … Read More

April 2025 Update+

Welcome to Update+, a short tour around the grounds of investment in the big disruptive trends that are driving business. This month, Portfolio Manager Anshu Sharma outlines the playbook for when … Read More

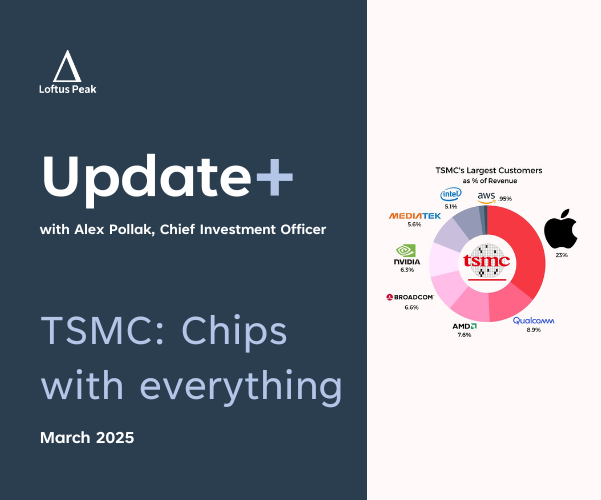

March 2025 Update+

Welcome to Update+, a short tour around the grounds of investment in the big disruptive trends that are driving business. This month, Chief Investment Officer Alex Pollak discusses the Artificial Intelligence … Read More

Rough weather demands a disciplined process

Markets have been roiled by the whip-saw policy changes of the US president. These abrupt shifts are not necessarily bad – they provide important pricing opportunities for the portfolios managed by … Read More