An important part of Loftus Peak’s Responsible Investment Policy – and the group’s investment philosophy since inception – is the belief that the world will move away from energy generated by burning fossil fuels towards energy harnessed through technology (energy as a technology, not a fuel). We are measuring and therefore managing the Fund’s carbon emissions through this transition.

We monitor the Carbon Intensity of the Fund’s holdings; the CO2 a company generates from its business activities, measured as tons of CO2 equivalent per million USD dollars of revenue (tCO2e/Mil USD). Included in this measurement are companies’ emissions from the manufacture and distribution of goods or services (“scope 1 and 2 emissions”), but not the emissions resulting from use of the goods or services (“scope 3 emissions”) – more on this difference later.

In 2021, the Fund as a whole carried a weighted average carbon intensity of 43.0 tCO2e/Mil USD against the benchmark MSCI All Countries World Index average of 166.1 tCO2e/Mil USD, making the Fund 73% less carbon intensive than the Fund’s benchmark. We believe this is an accurate reflection of the way the Fund is positioned to avoid causing harm, as well as benefit from the way disruption is playing out in energy. However, focusing only on carbon intensity would remove some of the Fund’s more critical environmental investments, which are the companies that deliver carbon solutions while at the same time having a heavy carbon footprint themselves.

Holdings of this kind include Linde as well as semiconductor names like Taiwan Semiconductor Manufacturing Company and On Semiconductor. These companies have emissions that are largely associated with high Global Warming Potential gases – ie which are thousands of times more powerful at trapping heat in the atmosphere than CO2. These gases are generated as manufacturing by-products, particularly deriving from refrigeration units in the case of Linde and wafer cleaning in the case of semiconductor fabrication. These companies make up for their high emissions by allowing consumers to avoid a greater amount of emissions than the company itself produces.

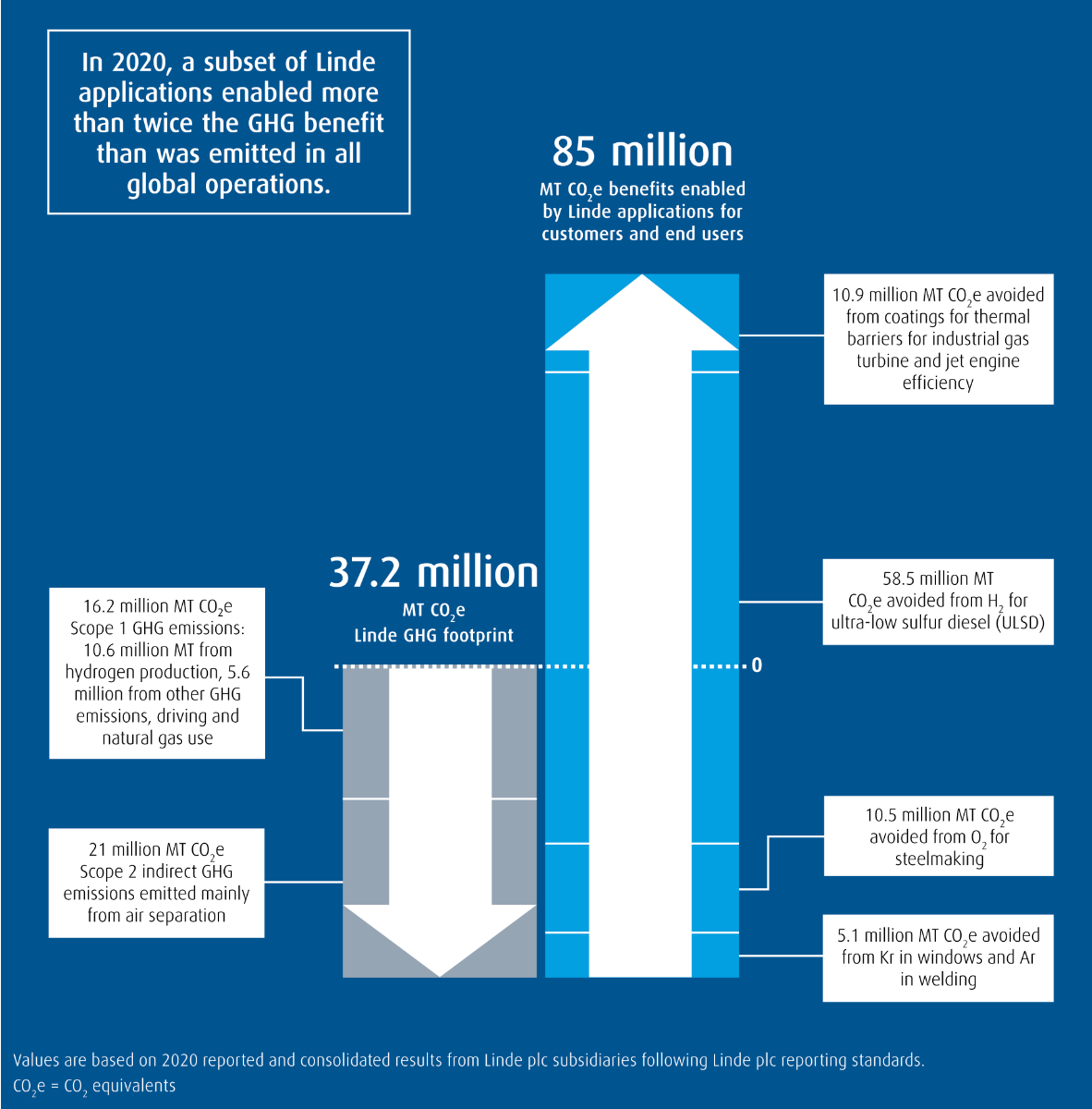

So notwithstanding today’s high carbon intensity, these companies are currently providing important carbon solutions. Linde stands at the forefront of fossil fuel reduction through its role in the hydrogen fuel industry. By 2020, Linde already estimated that for every ton of CO2e generated by operations, 2.3 tons were avoided by their customers.

Linde’s Carbon Productivity Chart

Source: Linde

Semiconductor fabrication works similarly; higher carbon intensity correlates with smaller microchip size which itself allows for more energy efficiency ie the computation requires lower heat, lower power and gives higher throughput. As in the case of Linde, consumers reap the carbon reduction for a proportionally smaller increase in carbon output on the part of the manufacturer.

The current high scope 1 and 2 emissions of these portfolio holdings can and are being reduced through improved best practices and are not necessarily inherent to their business models. As a result, they do not stand to become stranded assets like fossil fuel-based business models.

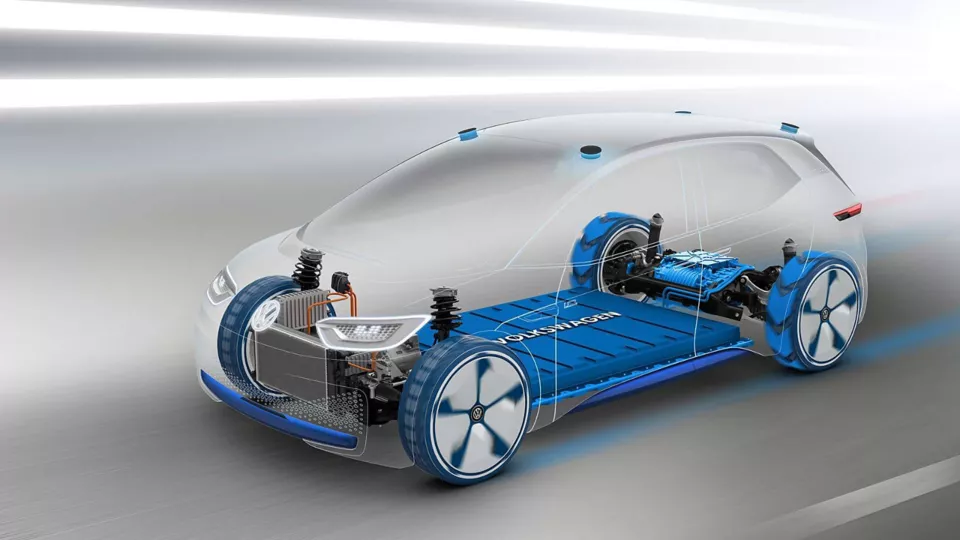

Some companies, such as internal combustion engine car makers carry high scope 3 emissions when used by the consumer. Volkswagen, another portfolio company, has the capacity to vastly reduce the scope 3 emissions of the cars it produces, and substitutes produced by competitors. Virtually any emerging electric car range is significant as a carbon solution. However, Volkswagen’s electrification is particularly so because of its existing scale of production. Volkswagen makes around 10 million cars per year across its various brands, making them the largest carmaker in the world, and so is best poised to amortise the huge investment of moving to electric while not having to greatly increase the number of cars produced.

Volkswagen’s Modular Electrification Toolkit.

Source: Volkswagen

Given the way we are positioning the Fund, we expect the Fund’s carbon intensity metric to decline over the long-term; many of the Fund’s holdings have committed to carbon neutrality by 2040, and even 2030 in some instances. We track, manage and publish carbon intensity to ensure we are on the right path. We also plan to continue to invest in the companies that stand to benefit from decarbonisation, acknowledging their contributions might not necessarily be captured by the carbon intensity metric. This approach will benefit our investors and the planet.

Share this Post