Markets have been roiled by the whip-saw policy changes of the US president. These abrupt shifts are not necessarily bad – they provide important pricing opportunities for the portfolios managed by Loftus Peak.

The most important rule of investing is to stick to the processes which have worked in the past but learn from mistakes. The Fund has weathered the chaos of the first Trump presidency, the Nvidia crypto trap of 2018, the China chip ban, the outbreak of Covid in 2020, the rise in interest rates in 2022 and now today’s challenges around tariffs and a somewhat unstable geopolitical environment.

Our valuation process, applied across every company in which we invest, supplies clear valuation signals based around changes in interest rates, revenue arcs and capital intensity.

We will not be abandoning these, and expect better times ahead.

Market awaits clarity from US$300b AI capex spend

Source: Reuters

Nvidia’s earnings late last month beat market estimates by US$2 billion (expected) and guided to a fiscal first quarter revenue sequentially higher by US$3.6 billion – higher than expected. Though positive, it was not enough to support an otherwise negative market, with the S&P 500 and the NASDAQ both declining over the past two weeks on renewed macroeconomic fears.

The market is fixated on the huge expenditure directed towards Artificial Intelligence (AI) hardware relative to the comparatively small amount of revenue the investment currently generates, but in so doing is overlooking recent history with respect to capital expenditure (capex) by the big hyperscalers.

The cloud investment cycle has paid off before…

By way of illustration, in 2013, Microsoft was already one of the largest companies in the world by market capitalisation. It owned the critical software installed across hundreds of millions of devices and extracted high margins from these licences. The company’s choice to re-invest earnings heavily into capex – specifically margin negative cloud data centres – was not well-received by the market.

Over the subsequent twelve years, Microsoft demonstrated the wisdom of its spending on its cloud business, Azure, which as of last quarter had an annual revenue run rate of ~US$75 billion and ~70% gross margins. There are similar stories over at Alphabet and Amazon. All these scenarios involve an initial stage of capex investment followed by revenue acceleration.

Now they are doing it again

This quarter Amazon, Alphabet, Microsoft and Meta have all exceeded market estimates for capex.

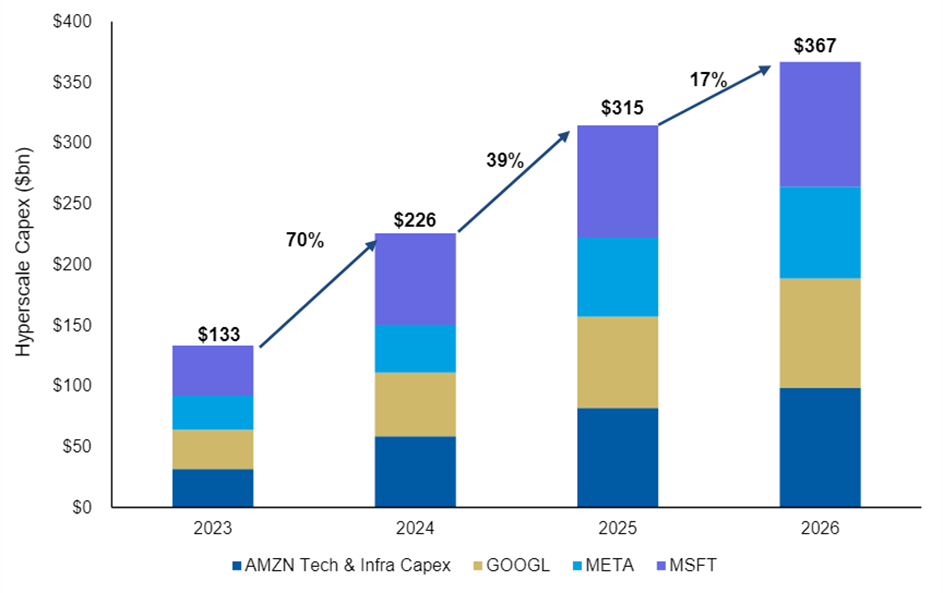

Combined, they are estimated to spend over US$300 billion in 2025. The following chart shows the dramatic increases in capex from the four biggest spenders since the AI trade started in 2022.

Source: Morgan Stanley, Company Filings

What’s more, in most cases more of this expenditure will be tilted toward chips. This contrasts with FY2024 where there was a heavier allocation towards buying land and building out the physical datacentres into which the chips were to be deployed.

Of the hyperscalers, only Microsoft has given guidance beyond 2025, pointing to capex increasing in the year to June 2026 as it tries to keep up with demand. That said, Broadcom (which sells custom AI chips to customers including major hyperscalers and is helping Apple design their first ever server chip) has forecast three individual accelerator clusters expected to be completed by 2027, each with a US$20 billion – US30 billion price tag. Two of these clusters are expected to be built by Meta and Alphabet, suggesting the capex of these two companies is not likely to moderate in the near term.

This is combined with large investments from Musk’s xAI, and Apple. Apple has just committed to spending US$500 billion over 4 years, some of which is marked for Apple’s AI private cloud ambitions. xAI, formed only 19 months ago, is already topping large language model benchmarks – it’s not just capital, but obviously technical expertise that are the main barriers to entry. Musk’s Grok (also known as xAI) plans on scaling up to a 1 million cluster (US$30-40bn worth of GPUs) which is equivalent to Nvidia’s most recent quarter sales.

If the capex isn’t going away, market scepticism seems unsustainable.

On Nvidia’s earnings call, CEO Jensen Huang said “AI is used in delivery services everywhere, shopping services everywhere. If a quart of milk is delivered to you, AI was involved. Every student will use AI as a tutor. Healthcare services use AI. Financial services use AI. And so, I think it is fairly safe to say that AI has gone mainstream, that it’s being integrated into every application.”

Share this Post