Alex Pollak (CIO), Harry Morrow (Analyst) From the outset, Loftus Peak has positioned clients to benefit from the changes that are occurring in business across the globe. The internet and digitisation … Read More

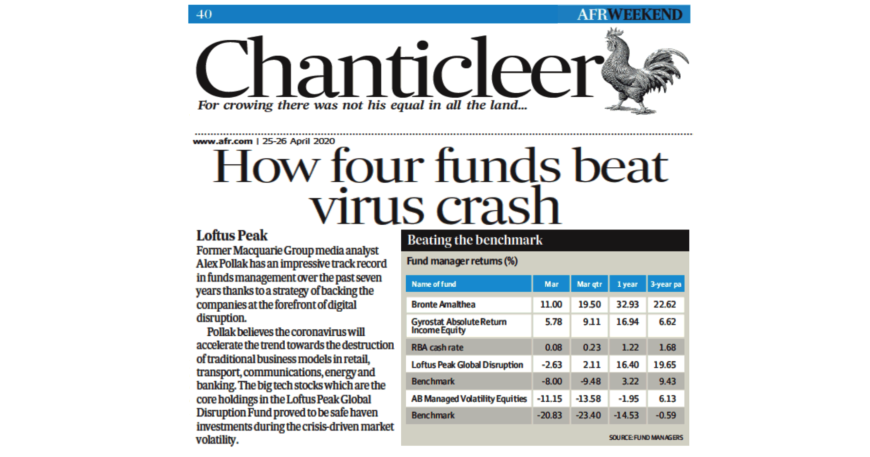

Loftus Peak featured in the AFR: How four funds beat virus crash

The below is an extract from Tony Boyd’s article ‘How four funds beat virus crash’ which was originally published to the Australian Financial Review on 25/04/20. For the full article, please … Read More

Loftus Peak building on ‘Disruptive Innovation’

Harvard Professor Clayton Christensen passed away in January. He was the father of what is known as disruption in business, and therefore someone Loftus Peak had always closely followed. He defined … Read More

Tesla surges, VW doesn’t. Here’s why

Alex Pollak, CIO Loftus Peak This article was originally published to Firstlinks. Google recently joined the trillion (US) dollar valuation club, of which Apple and Microsoft are already members at around … Read More

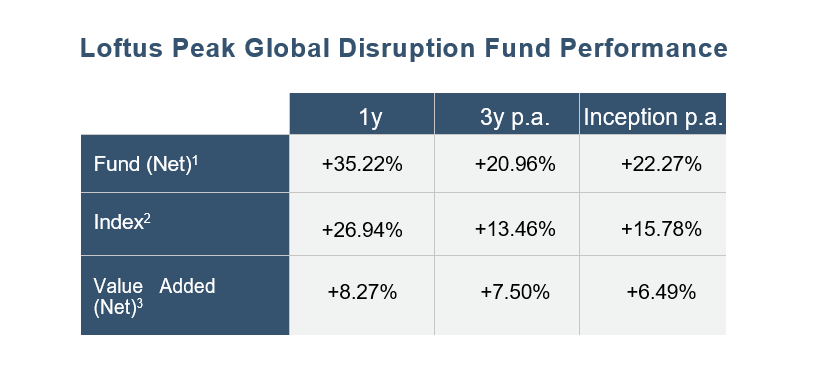

What drove Loftus Peak’s +35% net-of-fees return for 2019

Alex Pollak, CIO at Loftus Peak What’s so special about the Loftus Peak Global Disruption Fund? Traditional business models are being disrupted as connectivity, networks and the sharing economy impact all … Read More

The Best Protection in a Market Downturn

Alex Pollak, CIO at Loftus Peak We have had several smaller corrections in the five years since our inception, with the largest downturn in the December quarter of 2018. CNN noted … Read More

Are You Investing in Your World?

Anshu Sharma, PM at Loftus Peak It won’t come as a surprise that over the last decade the average daily time spent on screens, which used to be restricted to television … Read More

Video: PEs don’t work. Here’s why.

Why single-period valuation metrics, such as PE multiples, can be misleading. A look into Loftus Peak’s valuation process. Find out more in the video below.

Loftus Peak appoints Rick Steele chief executive

By Greg Bright (originally published to Investor Strategy News) Loftus Peak, a boutique equities house, is expanding its remit with the appointment of a professional funds management chief executive. Rick Steele … Read More

Video: Why was Loftus Peak established?

Loftus Peak was created to give Australians exposure to listed global disruptive companies. These are the companies changing the world around us, or providing the tools that facilitate this change. Our … Read More

Video: Why companies don’t disrupt themselves (Uber and the taxi industry)

Loftus Peak invests across retail, banking, media, transportation – across the whole market – but with a focus on companies that use all the available tools at their disposal to build … Read More

SQM Research re-affirms Superior rating for Loftus Peak’s Global Disruption Fund

Loftus Peak is pleased to announce that the Loftus Peak Global Disruption Fund’s 4 star ‘Superior’ rating has been reaffirmed by SQM Research. On receiving the reaffirmed 4 star SQM rating, … Read More