The below is an extract from Tony Boyd’s article ‘How four funds beat virus crash’ which was originally published to the Australian Financial Review on 25/04/20. For the full article, please click here.

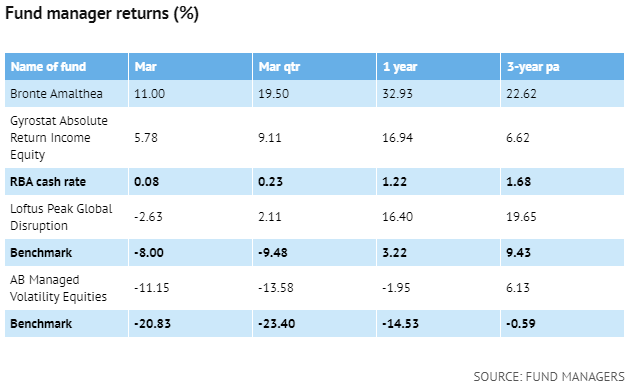

The idea for this column was simple – find four fund managers who did well during the coronavirus crash in February and March while delivering on the promises they made to investors.

Doing well was defined as being in the top percentile of returns in the category or cohort that applied to each fund. Delivering on promises refers to the decisions taken by each fund manager to meet their stated objectives.

To get an idea of the volatility in March and in the March quarter, the best- and worst-performing funds from the 430 in the Australian Fund Monitors database were plus 38.29 per cent and minus 77.28 per cent in March, and plus 64.38 per cent and minus 87.07 per cent in the March quarter.

Loftus Peak

Former Macquarie Group media analyst Alex Pollak has an impressive track record in fund management over seven years, thanks to a strategy of backing the companies at the forefront of digital disruption.

Pollak believes the coronavirus will accelerate the trend towards the destruction of traditional business models in retail, transport, communications, energy and banking.

The big tech stocks, which are the core holdings in the Loftus Peak Global Disruption Fund, proved to be safe investments during the crisis-driven market volatility.

Pollak says Apple, Netflix, Amazon and Tencent have highly adapted competitive strategies and they will do even better as people adopt new behaviours around work practices, entertainment and shopping.

He says the Loftus Peak investment strategy can be summed up with a word his team invented – “cloudification”, which refers to the use of cloud computing to make the digital economy work at scale.

Pollak operates the fund within a handful of risk parameters, including a limit on its exposure to any [high-risk] stocks to 1.5 per cent of assets.

He says this means it does not mind if a company goes broke but that is unlikely given his preference for those with strong cash flow, successful business models and sound balance sheets.

In line with international fund managers operating with largely unhedged portfolios, the fund benefited from a 5 per cent decline in the Australian dollar in March.

Share this Post