Loftus Peak is pleased to announce that the Loftus Peak Global Disruption Fund’s 4 star ‘Superior’ rating has been reaffirmed by SQM Research.

On receiving the reaffirmed 4 star SQM rating, Alex Pollak, Loftus Peak founder, said “I am very pleased with what we have achieved in the first 5 years of operation and appreciate that this has been recognised by SQM, a group with a strong reputation in critically assessing fund managers.”

Loftus Peak believes the report highlights key benefits we provide investors relative to other fund managers, including:

Diversification for Australian investors

- Low correlation to the ASX300 – one-year rolling correlation averaged 47.4%. SQM suggests that the moderate correlation to Australian Equities suggests that the Fund may provide some diversification benefits and also downside mitigation, particularly in times of substantial negative returns from Australian Equities.

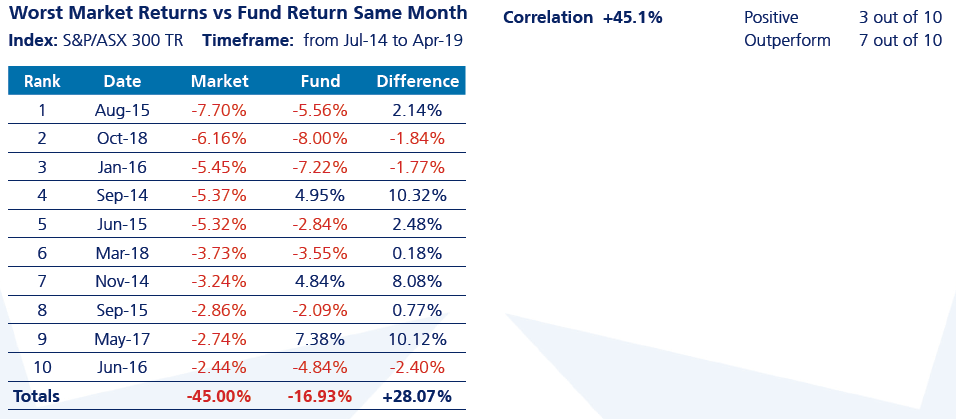

- Tail risk – in the ten largest negative monthly returns for the ASX, the sum of returns was -45.0%. In those same months, the sum of the Loftus Peak Global Disruption Fund returns was -16.9%, a difference of +28.1%. Table below.

Strong risk-adjusted returns

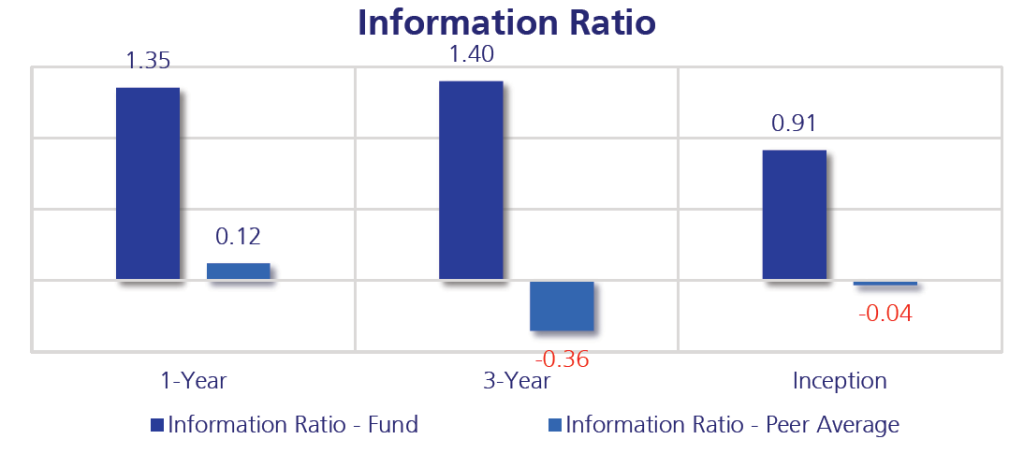

The information ratio measures the consistency with which a fund manager generates excess returns. While SQM does not comment on what a ‘good’ information ratio is, generally an information ratio in the 0.40-0.60 range is considered quite good. Information ratios of 1.00 for long periods of time are rare. The chart below suggests consistent excess returns above that of peers.

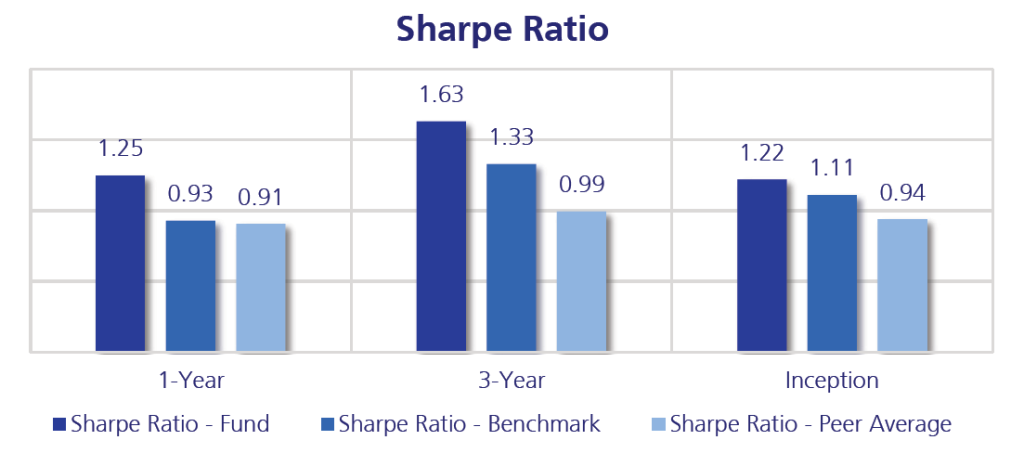

The Sharpe ratio is another common measure of risk adjusted returns.

A unique approach relative to other fund managers. SQM stated the following

- The investment philosophy combines thematic and fundamental approaches, which together assist in managing risk and optimising returns. The Fund’s idea generation includes sources that are not often employed by traditional fundamental managers.

- The disruption theme as a pure play is relatively scarce in the managed fund space.

- The proprietary valuation model used was uncommon but a logical and coherent approach to investing in these type of stocks.

The full report is available on request to financial planners by clicking on the SQM logo at the bottom of the page and completing the subsequent form, or contacting us at enquiry@loftuspeak.com.au.

The Lonsec research report is also available using its respective logo.

SQM Research disclaimer: The rating contained in this document is issued by SQM Research Pty Ltd ABN 93 122 592 036 AFSL 421913. SQM Research is an investment research firm that undertakes research on investment products exclusively for its wholesale clients, utilising a proprietary review and star rating system. The SQM Research star rating system is of a general nature and does not take into account the particular circumstances or needs of any specific person. The rating may be subject to change at any time. Only licensed financial advisers may use the SQM Research star rating system in determining whether an investment is appropriate to a person’s particular circumstances or needs. You should read the product disclosure statement and consult a licensed financial adviser before making an investment decision in relation to this investment product. SQM Research receives a fee from the Fund Manager for the research and rating of the managed investment scheme.

Share this Post