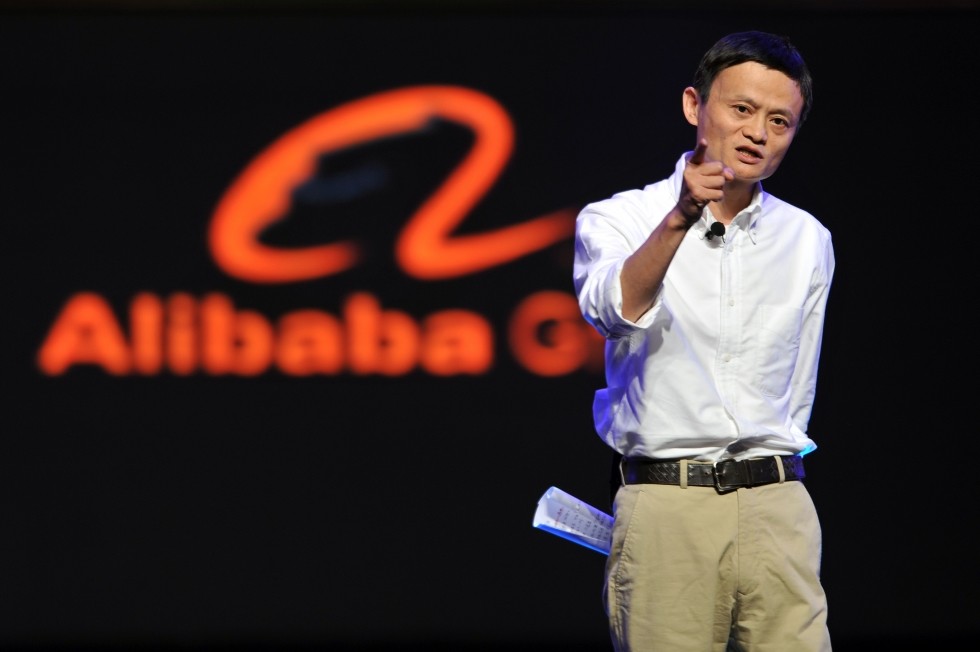

Now that Alibaba has popped 34% it’s all over for the company, right?

Wrong. Actually, the numbers for the company even at US$231b valuation are, frankly, compelling.

Alibaba derives its sales on the percentage of gross merchandise volume (or GMV) that it sells. GMV for the most recent quarter (to 30 June 2014) was US$81.7b – up a whopping 45%. I expect there to be some lumpiness in these figures, but the mere fact that a company can get to an annualised rate of US$327b in sales and still be growing at 45% is staggering.

BABA does not report its quarterly sales at at the GMV level of $81.7b It reports the actual 3.1% commission received at US$2.54b. Using the Bloomberg revenue forecast for the next four quarters puts revenue for the coming year at US$12.65b.

What happens in the year to June 2015 if BABA holds this growth rate?What happens in the year to June 2015 if BABA holds this growth rate? If we assume that costs remain the same (which is largely correct, since BABA is a fixed cost business, meaning that the amount of servers, staff and general expenses would not change materially on double the revenue) then the numbers start to really mess with your head. BABA EBITDA would jump from an annualised level of US$5.5b to US$8b – up 45%.

At that point, BABA would be 27x EBITDA forecast earnings for the coming 12 months. If growth continues at that rate, the multiple drops to 15.8x the following year. Should it continue? Remember, Chinese internet penetration is roughly half that of the US and Europe, with active buyers of 279m on a population base of 1.3b.

BABA is in fact an old fashioned exchange – the buyers go where the sellers are, and vice versa. Once established, these models are very hard to break. Carsales is one, and its forward EBITDA multiple is 15.6x, while eBay is at 10.7x, and Amazon is 24.1x. In this context, we begin to see just how sweet the BABA is.

Disclosure: Loftus Peak owns Alibaba through Yahoo! Inc

What will disrupt the disruptors?

27 Jun 2025E&P’s Words on Wealth Podcast interviews Alex Pollak and Raymond Tong on ‘AI’s Expanding Reach’

26 Jun 2025‘Beating the market in a time of hyper-disruption’: Alex Pollak features on EquityMates Basis Points

25 Jun 2025Cage fight: Trump v Musk! Alex Pollak features in SBS On the Money

15 Jun 2025Share this Post