Loftus Peak is pleased to announce that SQM Research has upgraded the rating for Loftus Peak’s Global Disruption Fund to four and a quarter stars. The Fund has re-affirmed its position in the ‘Superior’ category.

SQM Research house was highly rated by managers in the Money Management’s 2020 ‘Rate the Raters’ survey for its thorough and professional process when it comes to providing ratings. We are pleased that SQM have recognised the sound basis of our disruption strategy and rewarded the Fund with a higher rating.

Loftus Peak believes the report highlights key benefits we provide investors relative to other fund managers which we show below.

A unique approach relative to other fund managers.

SQM stated the following:

- The team at Loftus Peak possesses considerable experience, knowledge and understanding regarding the concept of disruption and how to best filter opportunities.

- The investment philosophy combines thematic and fundamental approaches, which together assist in managing risk and optimising returns. The Fund’s idea generation includes sources that are not often employed by traditional fundamental managers.

- The investment process is robust and focuses on valuing stocks via discounted cash flows. The methodology includes elements that control or manage the risks such as a ‘risk rank score’ for each stock which allow for management of the risks inherent in valuing disruptive companies.

Strong risk-adjusted Returns

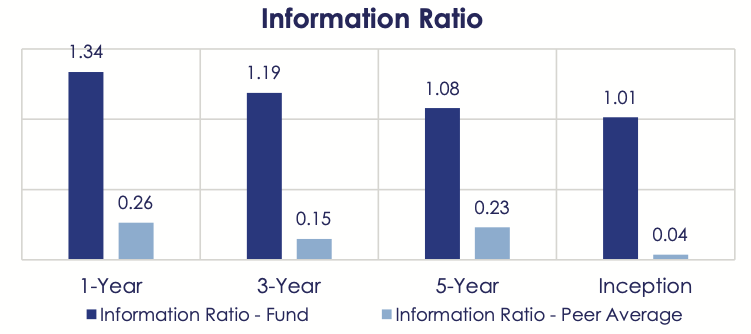

The information ratio measures the consistency with which a fund manager generates excess returns. While SQM does not comment on what a ‘good’ information ratio is, generally an information ratio in the 0.40-0.60 range is considered quite good. Information ratios of 1.00 for long periods of time are rare. The chart below suggests consistent excess returns above that of peers.

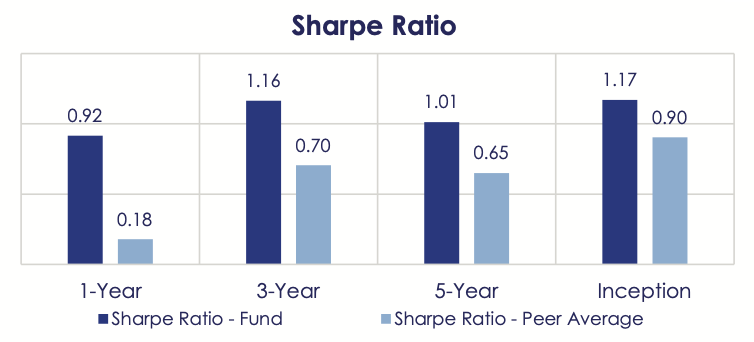

The Sharpe ratio is another common measure of risk adjusted returns.

Diversification for Australian investors

- Low correlation to Australian equities – three-year correlation of the Loftus Peak Global Disruption Fund to the S&P / ASX300 was 47.07%.

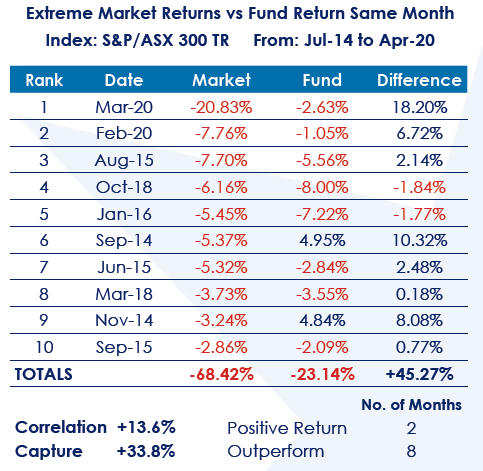

- Relative outperformance during Australian Equity tail events – in the ten largest negative monthly returns for the ASX, the sum of returns was -68.4%. In those same months, the sum of the Loftus Peak Global Disruption Fund returns was -23.1%, a difference of +45.3%. Table below:

SQM suggests these figures point to significant defensive characteristics of the Fund in the face of extreme Australian equity tail risk.

The full SQM report is available on request to financial planners by clicking on the SQM logo at the bottom of the page and completing the subsequent form, or contacting us at enquiry@loftuspeak.com.au.

The Lonsec research report is also available using its respective logo at the bottom of the page.

SQM Research disclaimer: The rating contained in this document is issued by SQM Research Pty Ltd ABN 93 122 592 036 AFSL 421913. SQM Research is an investment research firm that undertakes research on investment products exclusively for its wholesale clients, utilising a proprietary review and star rating system. The SQM Research star rating system is of a general nature and does not take into account the particular circumstances or needs of any specific person. The rating may be subject to change at any time. Only licensed financial advisers may use the SQM Research star rating system in determining whether an investment is appropriate to a person’s particular circumstances or needs. You should read the product disclosure statement and consult a licensed financial adviser before making an investment decision in relation to this investment product. SQM Research receives a fee from the Fund Manager for the research and rating of the managed investment scheme.

Share this Post