Chapter One

Nokia gone: How could this happen?

About a month ago, Microsoft fired the last two executives entrusted with the Nokia vision, Stephen Elop and Jo Harlow. In early July it wrote off the entire US$7.6b it paid for Nokia just 15 months previously. How could this happen so quickly?

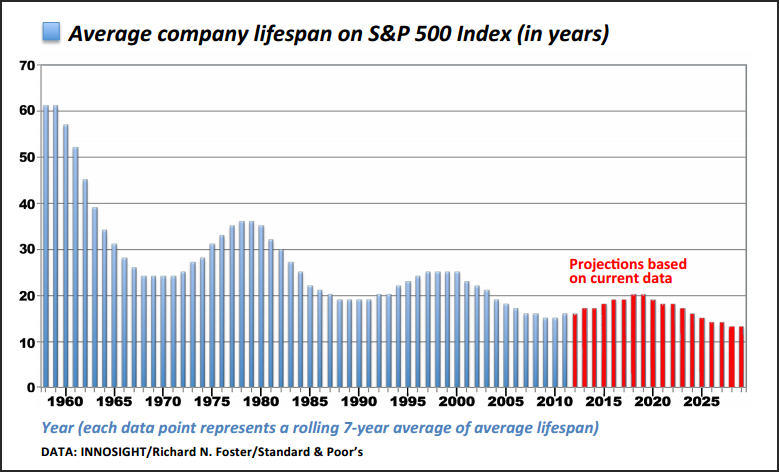

Companies, it seems, are not living as long as they used to. A casual comparison of the 2014 and the 1995 Fortune lists of the top 100 companies reveals a startling fact; forty-four of the names have gone. The average lifespan of a company has dropped from around 60 years in 1960 to under 20 years, as the chart below from MIT Technology Review shows. At the current churn rate, 75% of the S&P 500 will be replaced by 2027.

Of course, gone doesn’t necessarily mean vanished, in the sense of bankrupt. Investors often talk about companies that were around then but have gone now in a cautionary way which implies that if you invest in the wrong company, your investment will vaporise, but it doesn’t usually happen like that. Some companies just drift out of the list, or get bought by other companies, remaining broadly relevant while they shuffle assets and hard-scrabble for economic relevance. But sometimes companies do vanish, in a meaningful valuation sense.

Like Digital Equipment Corporation (number 65 in 1995) whose founder famously predicted “the personal computer will fall flat on its face in business.” Merrill Lynch was pushed into the arms of Bank of America having been caught badly in the 2008 global financial crisis. Eastman Kodak missed the memo about the end of film, having virtually invented the first digital camera. Chrysler has traded hands multiple times in the past thirty years, from private equity to car-makers like Daimler-Benz and Fiat, which now owns it.

3M is still around, but no longer makes the cut, while McDonnell Douglas was out-competed by Airbus and Boeing, with which it merged in 1997. Also falling off the list was tobacco company Altria while Sara Lee and ITT were split up and renamed. Sometimes management just disappear companies: like Worldcom/MCI Communications.

Google bought Motorola for US$13b in what is considered a largely failed transaction, selling off the phone business to Lenovo, but keeping the patent suite. As noted, having bought Nokia a less than two years ago, Nokia is now gone as a viable entity (though you will see the products for a couple of more years).

IBM is present on both lists but it’s very different today compared with 1995. To illustrate: the personal computer business (laptops, PC’s etc) was sold off to Lenovo. The mainframe business is still there, and beloved by banks, but is becoming less relevant in the overall revenue mix as more of the big enterprise computing solution shifts to the cloud (which IBM is also offering). Along the way, IBM purchased Micromuse, Texas Memory Systems and Kenexa. Going back a ways, IBM sold its printer company Lexmark. So IBM is still the same IBM. In the same way as the proverbial axe, which, having had 5 new heads and 7 new handles, is still the same axe.

Companies change – they get born, grow, mature and die. And they are doing so faster than they used to, as the chart above shows. And what flows from this is a capital L Learning: people now live longer than companies.

What does “blue chip” mean in that context? Most people still think that blue chip means safe, established and profitable but that is a misunderstanding of the original term which was only about price. The rate at which companies are falling out of the top 100 lists makes a lie of the idea that these companies are safe. They may look safe, but investors are unknowingly taking on more and more risk as the speed at which change occurs turns the top 100 upside down.

Most people still think that blue chip means safe, established and profitable but that is a misunderstanding of the original term.

And to take this to its logical conclusion, if companies are not living as long as they used to, that means that new, better (and these days often disruptive) companies are entering the top 100 list faster than they used to.

And for every company that enters, one must leave. By definition, the companies that have to come out are blue chip. This, then, is where the unravelling starts: at the blue-chip end.

Yet most managers and many self-managed super funds are turning to blue chip companies for safety, hoping their steady earnings streams will provide for increasingly long retirements. And as we have seen, they carry way more risk than they used to, because their lives are shortening. So here is the second capital L Learning: Investing in blue chips is riskier than it seems.

This is chapter one of Retirement, investments and blue-chips: What you really must understand by Alex Pollak. Download a full copy of the book here.

Chapter Two

Here are all the things you are not being told

To continue reading click here for the ebook.

E&P’s Words on Wealth Podcast interviews Alex Pollak and Raymond Tong on ‘AI’s Expanding Reach’

26 Jun 2025‘Beating the market in a time of hyper-disruption’: Alex Pollak features on EquityMates Basis Points

25 Jun 2025Cage fight: Trump v Musk! Alex Pollak features in SBS On the Money

15 Jun 2025ASX’s The Idea Exchange Podcast interviews CIO Alex Pollak on ‘The art of disruption’

10 Jun 2025Share this Post