Source: Shutterstock

A vicious circle for traditional TV

The Netflix stock price was pummelled in early 2022 as its subscriber base decreased on a quarterly basis for the first time ever. Some investors were quick to declare that the streaming opportunity was smaller than first anticipated and the best of Netflix’s growth was behind it. But the company finished the year with a net increase in subscribers and is expected to re-accelerate its revenue growth in 2023. It is now in the enviable position of being the only profitable long-form streaming company in the world. Since the lows of 2022 the stock has doubled.

The table below shows Netflix’s streaming profitability against the enormous and still mounting losses of its competitors.

Netflix remains the only profitable long-form streaming business

Source: Company Filings, Morgan Stanley, figures in US$M unless otherwise stated, data as at 31 December 2022

EBITDA = earnings before interest, tax, depreciation and amortisation, TTM = trailing twelve months

Advertising rebound for streamers – but for traditional TV not so much?

Netflix first quarter numbers were released last week, from which there are two takeaways. In the US, the company has reported that the basic-with-ads plan (for which they charge US$6.99/month) generates more revenue per user than its standard plan (at US$15.49/month). This indicates over US$8.50 of incremental advertising revenue per sub – an incredibly strong start for an advertising business that launched just five months ago. Far from struggling to make net profit, Netflix repurchased US$400m of its own stock in the quarter and plans to increase the pace of stock repurchases for the remainder of 2023.

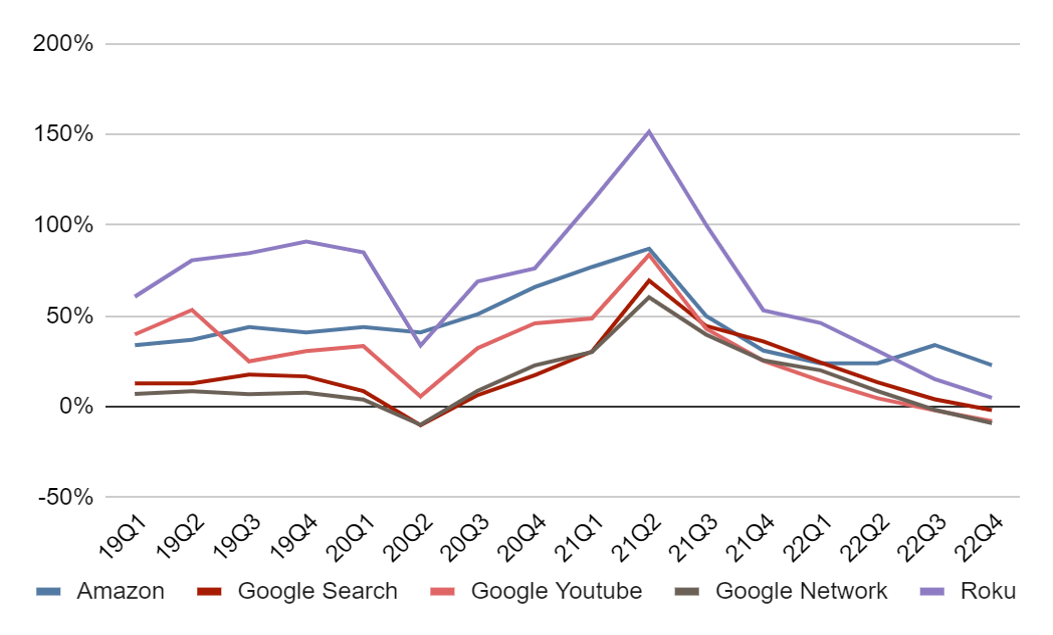

Netflix’s move into advertising is well timed, since advertising is expected to recover after a pull-back in 2022 (as shown in the chart below), which will also benefit our holdings in Google (through search and YouTube), as well as Amazon (with its product placement revenue) and Roku.

Year-on-year % ch in advertising revenue growth across selected portfolio holdings

Source: Company Filings, Loftus Peak

Roku’s active accounts have surpassed 70 million globally, with around 50% penetration of US households. These numbers recently forced no less a player than Disney into giving up a portion of its advertising inventory to the company which, candidly, it would have formerly regarded as mostly irrelevant.

Storm damage report: Will traditional TV go the way of print?

Industry-wide growth cuts in advertising spend unfasten sticky advertising money from disruptive and traditional companies alike. The 2022 weakness in advertising hurt our streaming names, but also squeezed the traditional players, as it did in the wake of the GFC. Cord-cutting -– disconnecting traditional TV channel bundles in favour of a group of a la carte streaming alternatives -– has produced an exodus of viewers from free-to-air and cable TV. The number of traditional TV viewers is down approximately 30% in the past 10 years in the US. For this reason, the re-acceleration of ad-spend may now prove the catalyst for the permanent loss of traditional TV ad revenue as advertisers deploy withheld monies to more effective (digital) mediums, in line with audience viewership.

As The Information reported this morning “Alphabet’s Google is sailing through the ad downturn reasonably well, all things considered. While it reported a fractional dip in first-quarter ad revenue earlier this week, its search ad number rose slightly. On the video front specifically, YouTube’s 2.6% decline was better than the 6.1% drop reported by Comcast’s NBCUniversal today for its domestic ad revenue. Meanwhile Amazon tonight reported a 21% increase in advertising.”

Another case in point: As of March, Sinclair Broadcast Group (SBG) subsidiary Diamond Sports Group is going through bankruptcy proceedings. The sports content channels which form part of the proceedings were purchased from Disney which itself bought them from Fox in 2019 for US$9.6 billion. Despite televising approximately a third of all major US baseball, basketball and hockey league games in local markets across 19 regional sports networks, the company was unable to meet a $140 million interest payment on its nearly $9 billion of debt.

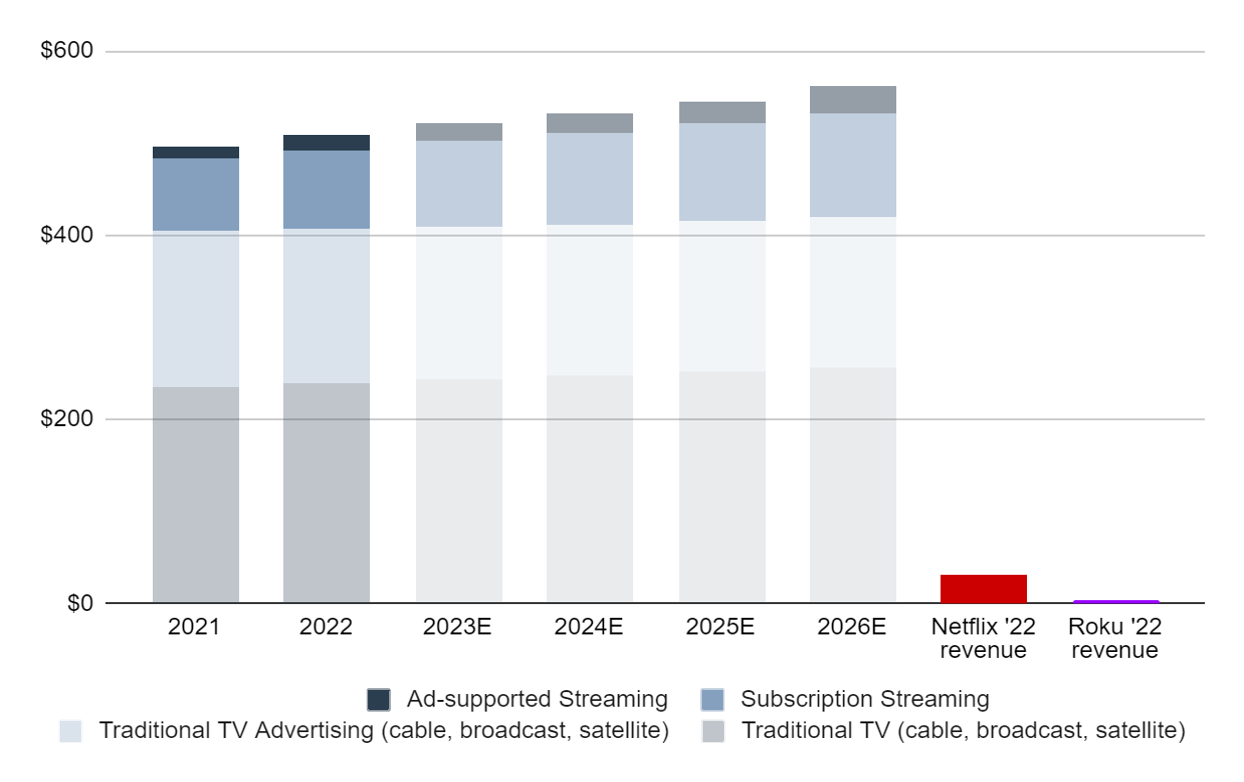

There is clearly a mismatch, as the chart below shows, between the total revenue of traditional TV and the streamers. Additionally within streaming, advertising represents a far smaller percentage of streaming’s total revenue relative to the historical precedent set by traditional TV (which can still be seen today).

Global TV Entertainment Revenue

Source: PWC, Magna, Grand View Research, Loftus Peak

If streamers continue adding subscribers and traditional TV continues losing – as has been the case so far – the share of entertainment revenue should fall further and further in favour of streaming.

Artificial Intelligence powers +9% March return

Meanwhile, disruption powered by artificial intelligence (AI) helped produce a return of +25.9% net of fees for Loftus Peak investors in the first quarter of 2023. Performance was driven by AI chip makers such as Nvidia as well as the companies that implement the intelligence through their application sets and datacentres.

Seeking a more accurate description for what AI will mean for the future of work, The Atlantic last month referenced the invention of the steam engine, “You might say: ‘This is a device for pumping water out of coal mines.’ And that would be true. But this accurate description would be far too narrow to see the big picture. The steam engine wasn’t just a water pump. It was a lever for detaching economic growth from population growth,” Derek Thompson wrote.

Profound, rapid change from AI may soon be considered at least as important. Steam engines leveraged physics. AI leverages the stuff of knowledge itself.

Share this Post