Reading time: 5 Minutes

Newsworthy in August was the artificial intelligence (AI) day held by Tesla. CEO Elon Musk wasn’t the first to flag the danger of AI for society – there have been many dark suggestions of a world where machines collectively have more intelligence than the humans who booted them up. In the Terminator film series, there is an exact moment when Skynet, the computer that goes to war against the human race, becomes self-learning, and from then on humans are progressively enslaved. You get the idea.

Irrespective of movie fiction, AI is here and Loftus Peak does invest in many (when applied constructively) elements of the artificial intelligence thematic – though not full, sit-in-the-back seat, self-driving car AI, which we believe is still a long way off. There are already a huge number of AI interactions in the daily activity of millions of people. Google searches are running at around 67,000 per second, and the company fields these queries using AI without human intervention on the basis of probability-weighted answers.

While the means by which this is done involves very complex maths, the process can be understood at a high level, and because Tesla is at the forefront of this, it is worth considering their approach.

For example, a front facing video camera on a car “sees” a shape 200 metres ahead. The AI in-car unit contains the processing power ie graphics processor units (GPU’s), central processor units (CPU’s) and “knows” a number of things, such as the speed at which its own car is travelling, the road on which both are travelling and so on. Since it processes multiple images, it is also able to tell if the shape is moving, and even the direction and speed. It fuses all these data together. None of the above is really AI – it’s just a data-gathering exercise, though done at lightning speed, and constantly.

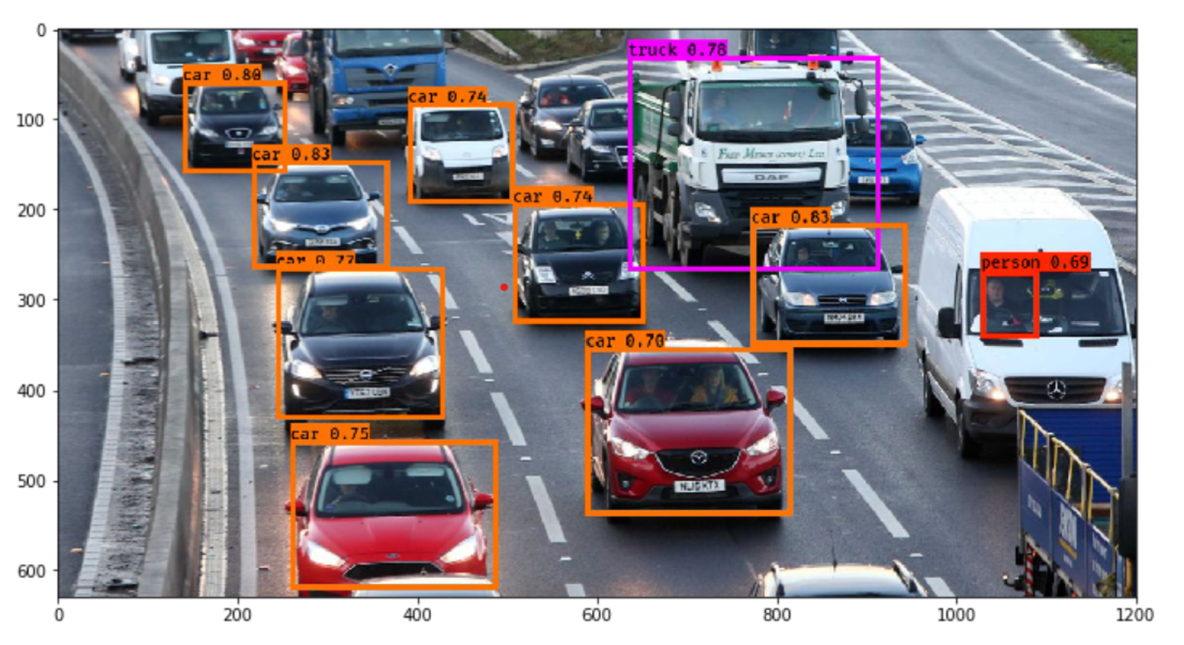

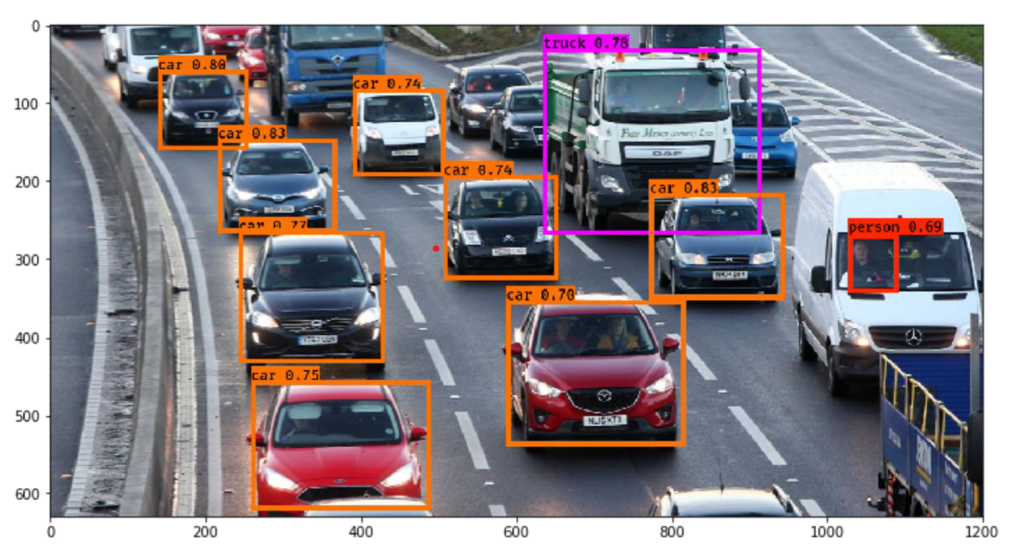

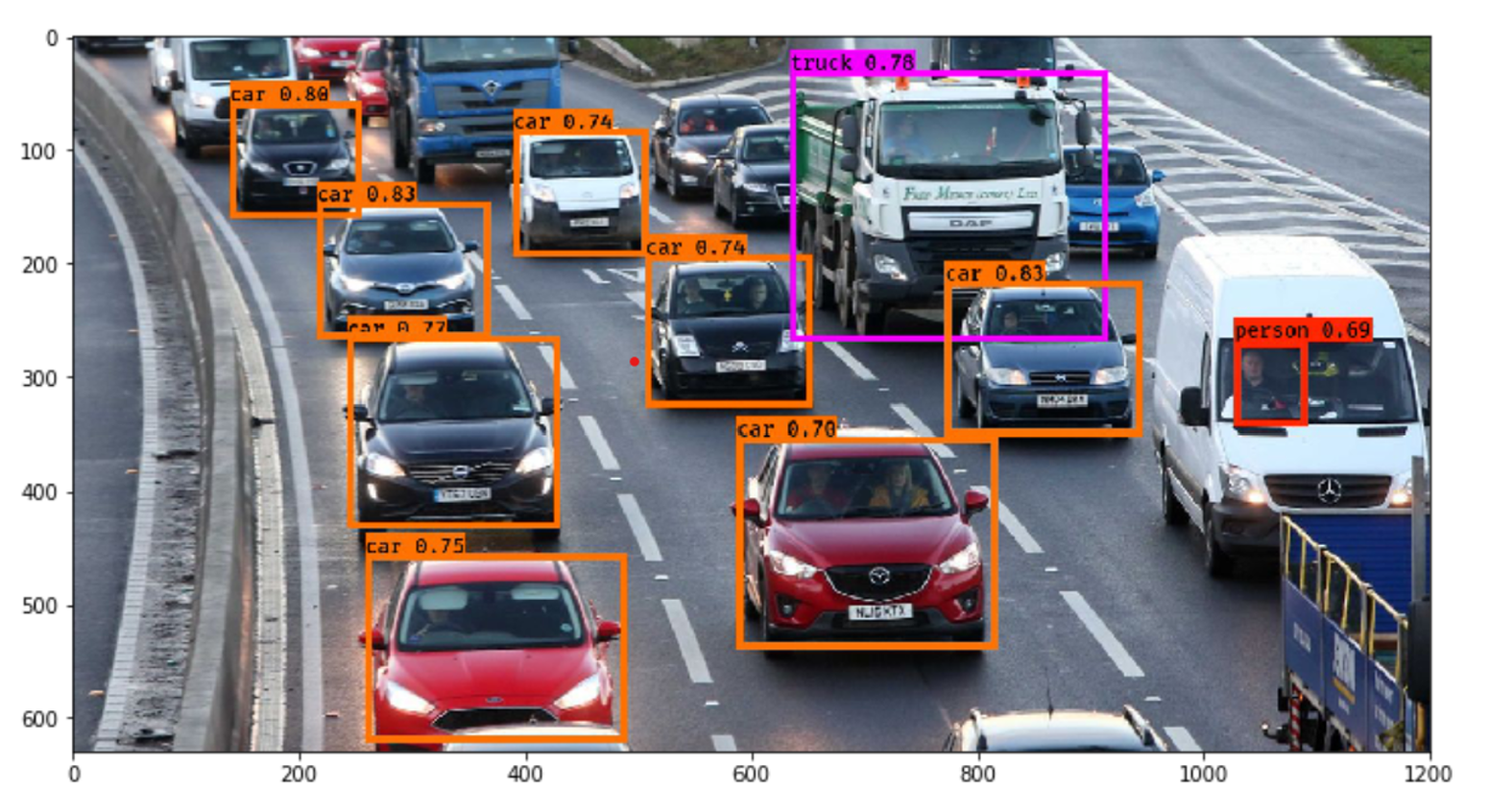

Now, the artificial intelligence part. All these data are fed to the AI, which determines what the shape is, based on probability. Perhaps if it is small and moving slowly, it is child, or if it is large, livestock. If the speed at which it moves is high, it could be a pushbike, or motor bike – or a car. If there are two headlights, could it be two motorbikes travelling abreast? As each millisecond passes, the AI re-evaluates the possibilities and discards them one by one – and then does so again, and again. This is a convolutional neural network in action, and it will generate a probability-weighted set of outcomes which it refines, thousands of times. The aim is to eliminate all the low-probability things the moving shape isn’t to arrive at the one that it (most likely) is. Only then does the AI take steps to deal with the shape (which could involve flagging to the driver a course of action – ie stopping, swerving, or ignoring it (say if it was a large plastic bag blowing across the highway).

The convolution part is so named because the image is refined against an existing image bank which includes many millions of pictures, so the system iterates by assessing how many of the elements match what is being seen. Now imagine the same situation at night, during a heavy rainstorm, and it is easy to see how this very hard problem suddenly gets much harder. Musk commented that accuracy to 90% is easy, even 99%, but for driving only 100% is acceptable – not even 99.9% works, for that suggests an error, maybe a fatal one, every 1000 car trips. Who would get into a self-driving car at those odds? And this is why full self-driving is still so far off, even for Tesla.

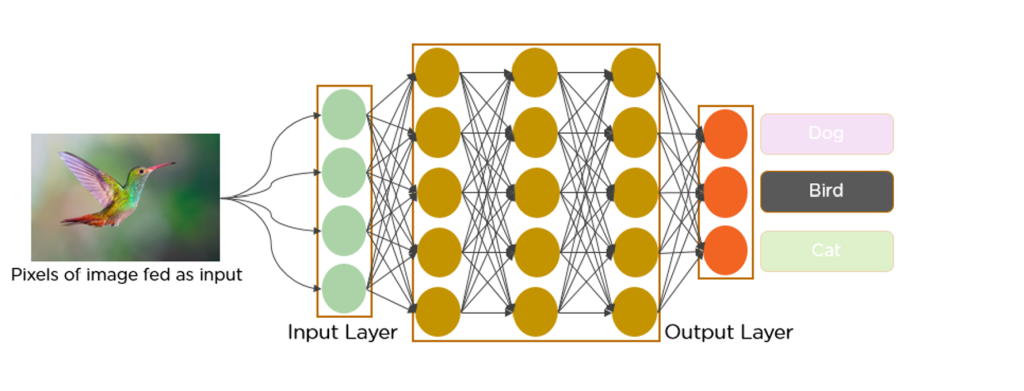

Here is a further simplified model.

AI is most definitely here in many day-to-day instances, and there is a lot more coming. Musk believes that Tesla is at the forefront of AI, and its real-world applications, including in robotics, see (video link here), and that it is likely monetisable and so worth something in the Tesla share price.

But there are a number of investment options here (though Tesla isn’t presently one of them in our view, because of its price). The graphics processor units which are integral to analysis of the images are made by Nvidia and AMD, both of which are in the portfolio. We also hold Xilinx, a company which is also important in image recognition and AI acceleration, along with Qualcomm, which is becoming important in the movement of all this data to centres in which it may need further analysis.

Google, Microsoft and Amazon are important for data management and applications. And remember, the product here isn’t the technology – it is a car trip (or a Google search, or Netflix TV show or a new pair of Nike shoes purchased online.)

When considering where to invest, we look at companies in one of more of these categories:

- creators of tools like the graphics processor units that Tesla uses for its AI;

- enablers (ie companies that create systems that use the tools) such as cloud and data centre players like Amazon, and

- beneficiaries, such Netflix and John Deere, which implement these as solutions for entertainment or agriculture

We do this because they offer better choke points than being in Tesla which is a highly concentrated bet in a single beneficiary.

Source: Boston Dynamics

Meanwhile the Fund returned +2.1% in August, but it was not enough to beat our benchmark, the MSCI All Countries World Index in Australian dollars, which rose +3.0% resulting in underperformance of -0.8%. The market is up on continuing easy money conditions, as Federal Reserve Chairman Jerome Powell cautioned the central bank not to overreact to this year’s inflation surge. At the same time, the “re-opening trade” appears to be running out of steam, with delta variant COVID causing flight and hotel cancellations and the ever present risk of further mutations.

The top performers for the month were Alphabet (Google), Netflix, Microsoft, Mercado Libre (Latin American e-commerce) and Crowdstrike (digital security), with our heavily-reduced China positions still creating some drag (which has actually reverved as this is written).

Google has been in a solid uptrend ever since COVID hit, having almost tripled from a low of US$1,008, as it showed quarterly revenue growth numbers of over 60% in the most recent quarter, as well as real momentum in YouTube in the most recent quarter..

The concerns during the past few months that Netflix was running out of growth were put to rest as the company launched a gaming service in selected markets, along with a new film slate. The blog, Ars Technica noted that Netflix games seems less focused on the delivery method and more on pumping out easily accessible product that leans on Netflix’s massive library of licenses.

Read the August monthly Fund performance report here. For previous monthly reports click here.

Share this Post