John Deere autonomous tractor – look closely to see Portfolio Manager Anshu Sharma in the driver’s seat!

John Deere autonomous tractor – look closely to see Portfolio Manager Anshu Sharma in the driver’s seat!

The Consumer Electronics Show (CES) – the first big technology conference every year – often sets a thematic tone. CES 2024 was the year of Artificial Intelligence (AI) devices. CES 2025 was the year of AI agents. For 2026, the theme was physical AI – that is AI deployed within machines (cars and robots) to make them autonomous.

The breadth of robotics and autonomy on display was significant, with Chinese companies representing around half of the booths. This theme of autonomy culminated with Nvidia CEO Jensen Huang unveiling a family of open-source physical AI models for deployment across autonomous vehicles and robots globally. The proof was a Mercedes powered by Nvidia that drove across San Francisco using AI under human supervision.

This is Tesla’s game to lose

As of January 2026, increasingly China is emerging as a leader in autonomous vehicles – which we saw first hand in a November 2025 two-week China research tour – with Apollo (owned by Baidu), WeRide, Pony.ai and Motional each operating in at least one Chinese city. Nvidia’s open-source model will make it even easier for new competitors to emerge. American offerings are also proliferating:

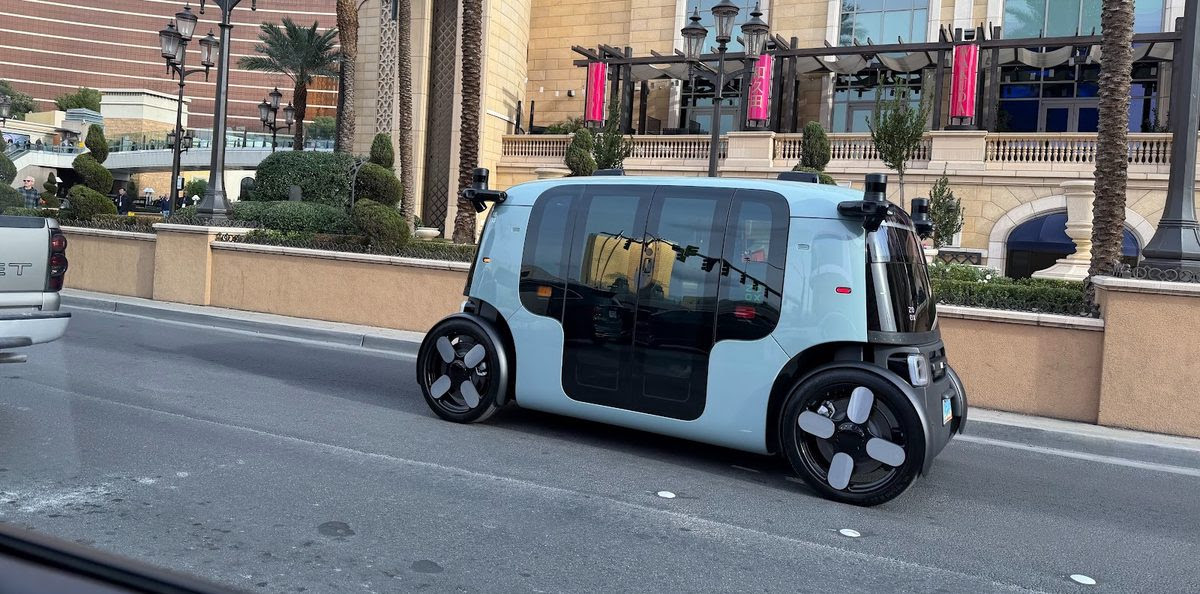

Zoox cars (owned by Amazon) were operating around CES.

Zoox cars (owned by Amazon) were operating around CES.

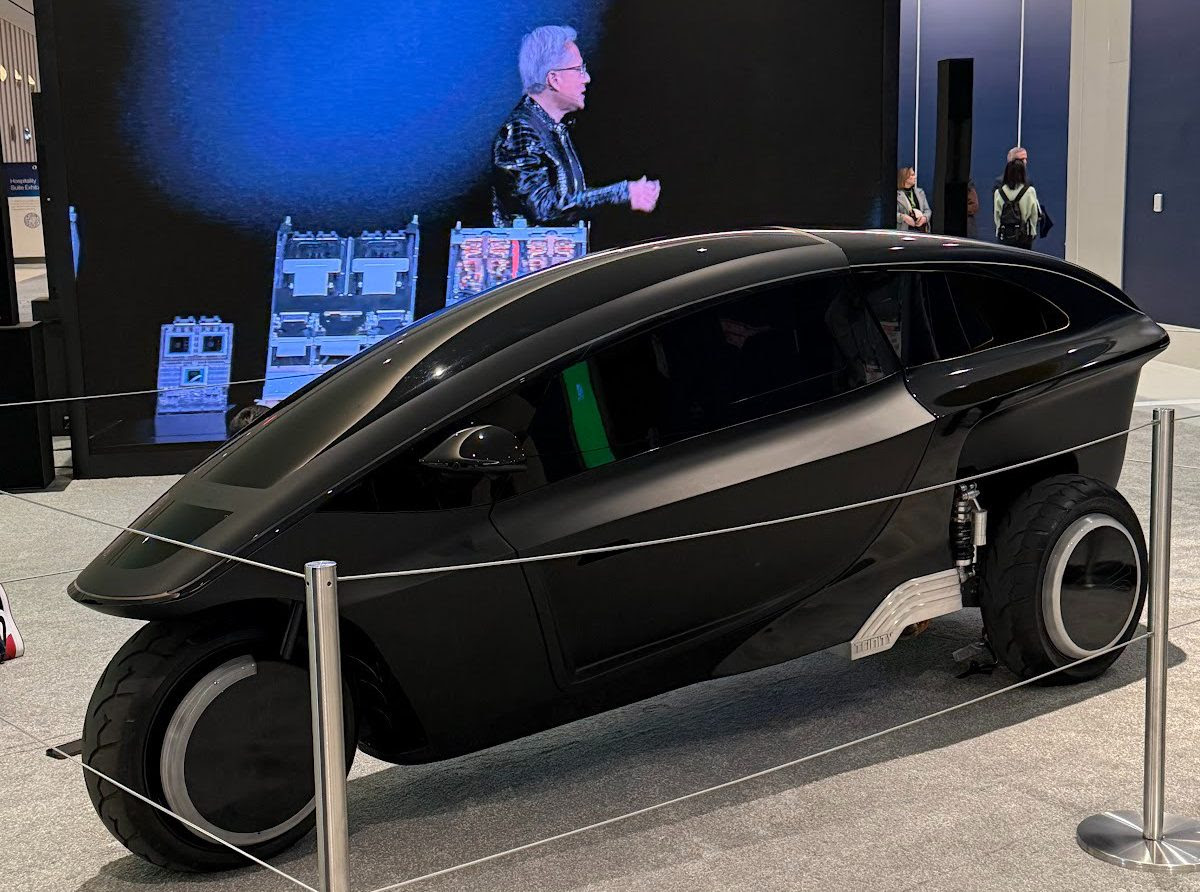

Prototype Trinity three wheeler

Prototype Trinity three wheeler

Robotaxi designed by Lucid, Nuro and Uber – set for launch in 2026

Robotaxi designed by Lucid, Nuro and Uber – set for launch in 2026

Waymo currently leads the market in autonomous driving technology, evidenced by its deployment in five cities (with more planned). However, the industry appears to be sliding further away from a winner-takes-all scenario due to the increasing breadth of competition (and not to mention Nvidia’s vested interest in democratising the technology).

Consequently, we see opportunity in the underlying value chain of autonomy. Specifically in underlying hardware for training and inference (Nvidia, AMD, Qualcomm & MediaTek) or demand aggregators such as Uber. In terms of the vehicles themselves, Chinese Auto OEMs offer the most compelling products and best vertical integration to compete with Tesla’s electric vehicles. At the mass market end there are companies like BYD while Xiaomi (historically a smartphone OEM) is launching into the luxury end of the market.

The threat is present for Tesla’s other darling – the humanoid robot Optimus

Robotics and humanoid robots were on full display at CES (click here for footage). The valuation of Tesla suggests strong leadership in this space, however the CES halls were full of humanoid robotics booths from various companies. These companies were predominantly Chinese. Nvidia has also open sourced much of the simulation and AI Vision-Language-Action (VLA) models that robots can use. Much like the cars, the scope for competition is growing both for humanoid robotics (what Tesla is aiming for) and function specific robots.

Function specific robots are already strongly deployed by AI savvy American companies and Chinese companies more broadly. Amazon reached its millionth warehouse robot deployment mid last year. Xiaomi rolls off a new car every 76 seconds, BYD does it in 60 – both using highly automated production lines. Chief Investment Officer Alex Pollak visited battery maker CATL’s factory in China a few months ago and management suggested that they had reduced people on the production lines by 60%. Interestingly, they suggested we were the first Australian investors to visit.

At Loftus Peak, we aim to view the world out to a 3 to 5-year investment horizon. The humanoid robots and especially the business ecosystems around them remain in a more development stage. Predicting which company will win is difficult, although Tesla valuations suggest this is a foregone conclusion. At this stage, we get exposure to humanoid robots through the semiconductors. Training on VLA models will require more advanced datacentre chips. This is why Nvidia is open sourcing these models. Further down the line, the robots themselves will require leading edge compute chips.

Share this Post