Dynamite fishing is a term used in angling to describe damaging behaviour that accidentally kills whatever else happens to be in the water nearby the fish that are the target. It is also being bandied around in finance markets with respect to the US Fed rate rises and the collateral damage that may occur simply by being proximate. In this case, the damage was £1.5 trillion worth of British pension funds which floated to the surface – stunned, but not dead (fortunately). It also required some very poorly thought-out skinny dipping by the now departed UK prime minister, Liz Truss. It’s not that there was a causal link between US rate rises and pension funds, but it is also true to say they would likely never have even been in trouble without the ‘dynamite’ of rising US rates, in place to fight inflation. That crisis has been averted for now.

Stock markets are being caught as well, obviously. Increased rates have forced valuations lower for risky businesses, but also for many extremely sound enterprises which are critical to the next phase of global growth.

The recent volatility seems more appropriate on a decades timeframe, rather than just the past few weeks. There are decades where nothing happens; and there are weeks where decades happen. (VI Lenin, reportedly, but paraphrased).

The most obvious example is the sell-off in stocks related to the car industry. Many of the largest carmakers in the world are working toward an architecture that is less reliant on fossil fuels. That is being coupled with the recognition that the driving public wants better safety applications available through technology, such as advanced driver assistance – for example pedestrian proximity warnings in low light conditions.

This means more sensors in each car, and more silicon chips to integrate the signals – a process known as sensor fusion. Commentary over the past few months has centred on the increased microchip content in cars to be built over the coming decade – from virtually zero a few years ago up to as much as $US3,000 per vehicle at the high end. Using a mid-point of $US1,500 per vehicle, and 90 million cars built annually, yields a silicon spend of $135 billion per year. Importantly, this industry did not exist five years ago.

![]() Source: Roland Berger, McKinsey

Source: Roland Berger, McKinsey

The Fund is exposed to this disruptive change through a number of positions – ON Semiconductor, which provides a power framework for the electric car, Qualcomm, which supplies compute inside the car (for Bluetooth connectivity used for music, movies and so on and connectivity to the world outside via 4G-5G modems), and Volkswagen as a scale maker of electric vehicles which next year will produce almost as many electric cars as Tesla, and three times as many by the time the company’s conversion to electric is completed.

How we invest

The US Federal Reserve Board’s fishing technique isn’t intentionally trying to create collateral damage. It’s just that higher interest rates generally can cause harm in unintended ways, as well as the ways which are intended.

The basis of the Loftus Peak Global Disruption Fund is the selection of a group of key thematics which will continue to drive disruptive business models, which we believe are very much present and will be so for some time. They are unlikely to be collateral damage, other than in the short term. For example, on a five-year view, we see the world consuming less fossil fuel, further embracing remote work through video conferencing and even virtual/augmented reality.

One of our thematics, networks, is underpinned by individualised connectivity through broadband, to perform a variety of different functions including banking, shopping, messaging and mapping. The companies the Fund holds under this thematic include Amazon, Apple, Alphabet (Google) and Microsoft. On these networks, each of which contain over one billion connected users, the companies build platforms which they use to market additional services.

In Microsoft’s case, its Azure cloud business enables users around the world to meet virtually through Teams to discuss strategy, design cars or buildings or even set budgets. The financial outlook for businesses such as these, whether Microsoft or Apple (which sells health, entertainment and financial services on its network) is very solid. The principle is simple: use the network to bring new services, at scale, to users. It is a powerful business model and has underpinned performance for Fund investors to date.

Of course, many companies, such as Coca-Cola and Ford have hundreds of millions of customers around the world on any given day. But their customers are not individually addressable. Never before in history have so many companies had these billions of customers with which they have been able to communicate and bill individually.

Another important thematic, connected devices (aka the “internet of things”) covers the data from sensors near and remote being integrated to improve business efficiency and reduce the draw on the environment. For example, managing the electrical grid, enabling precision agriculture, monitoring forests for fires remotely (rather than using trucks covering hundreds of miles on petrol, on patrol). This too is a very fast-growing area, through which we are exposed with companies such as Qualcomm and Advanced Micro Devices.

All this information would be sterile without the processing required to make something of it, which is part of the data and machine learning thematic. Simply put, the estimated 63,000 Google searches/second could not happen without processing power, and neither could all the Uber navigations taking place at any one time.

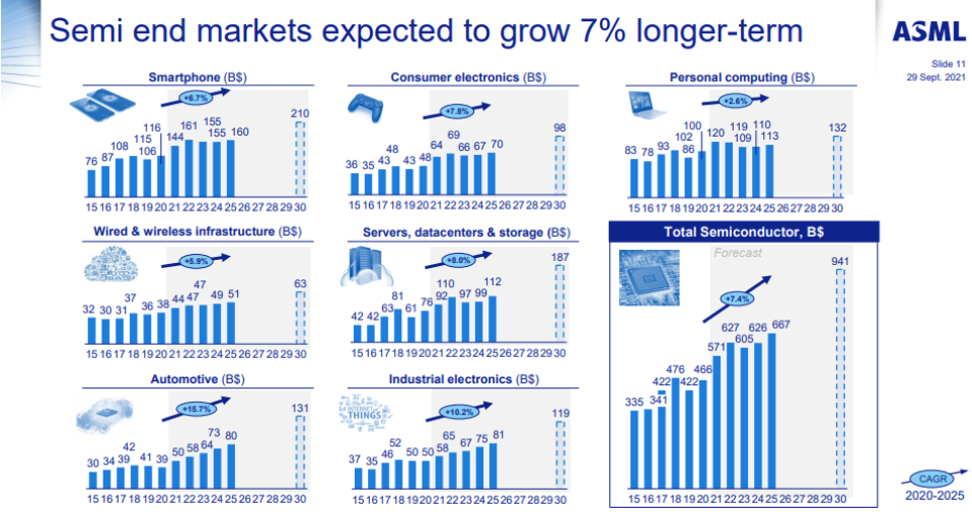

We invest in this thematic through companies producing and designing the cutting-edge semiconductors without which none of this would be possible. The chart below shows projected growth in the use of processing power over the coming five years.

Source: ASML

Source: ASML

We have already dealt with the business implications of electric cars, which form part of the broader thematic of energy as a technology, not a fuel. Suffice to say that the harnessing of energy which is all around us creates very different outcomes to those in which energy is extracted and then burned.

Importantly, these core thematics have driven the investment performance of the Fund. We believe that the investment framework applied to managing the Fund will continue to drive future investment performance.

Share this Post