It’s only a year ago that we highlighted the incredible progress made by US robotics pioneer Boston Dynamics with its four legged ‘robot cheetah’, and now we see the two legged … Read More

It’s the model, stupid…

It’s not about interest rates, or dividends or technical trends or any of the other hyped nonsense which passes for commentary, and last night we had the proof. Global indices fell, … Read More

Malcolm and the unicorns – first published in The Sydney Morning Herald

Malcolm Turnbull is absolutely right to be throwing the switch to innovation – Australia is not going to mine or bank its way into an improvement in its long term growth … Read More

Atlassian – worth a lot more than US$3.3b?

The F1 (effectively a prospectus without a price) for Atlassian reveals a lot of figures, but is silent on the main one – how much the business might be worth. I … Read More

Weak data in China? Not in these names…

The world has been very nervous about China in the past two months, with a series of weak data prints (lowest quarter industrial sector growth in 20 years at 5.8%, bearish … Read More

Australian blue chips? Absolute shockers…

The US reporting season, which is currently in full swing, has dramatically illustrated the difference in the performance of traditional blue chip Australian companies relative to those that are disrupting them. … Read More

Start-ups or disruptive corporations? Where best to invest?

Big news in disruption in the next few days, with Amazon reporting Friday morning (Aussie time), Google the day after and Apple on Thursday. An equal dollar investment in all three … Read More

Who gets caught when the markets say ‘Gotcha!’ to fossil fuels?

We have been led to believe that the planet is the first victim of our slowness to move to renewable energy. It is the second. The first group affected are those … Read More

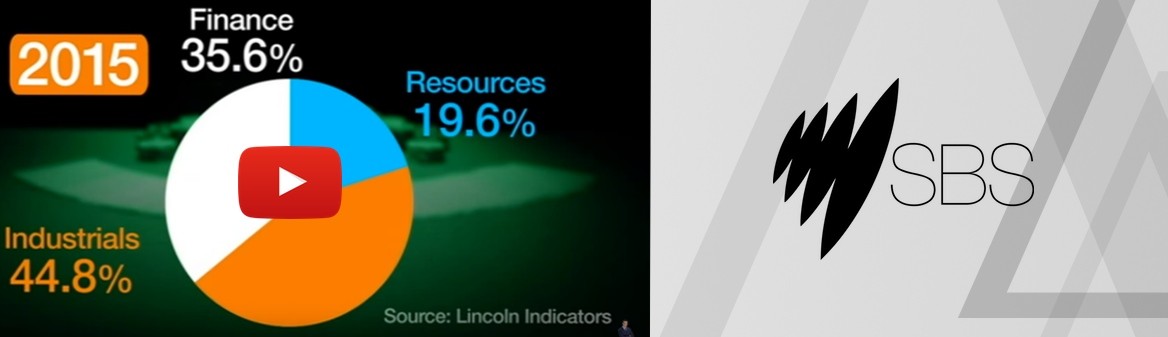

What’s under the hood of your Super Fund

This post was originally published on the SMH. Click here to read it on the SMH website. The release of quarterly super fund data today showing negative returns for balanced funds, including a … Read More

What is the next big disruptor?

The environment, including triple-bottom line reporting and even gender. “Of course.” You say. “I knew that.” You probably did. We have always thought of technology as the big disruptor, and it … Read More

VW’s car ‘accident’: Don’t waste a crisis

Quick quiz. By how much do VW, BMW, Daimler Benz and Ford exceed the value of Tesla? The equity in Tesla is valued at US$33b on the stock market. Daimler is … Read More